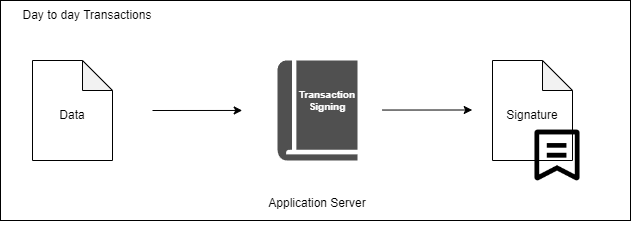

You might have read the post on Transaction Signing for ALL by Fareez, which gave a great overview of why Transaction Signing is important and its benefits. In this blog, we explore the technical aspects of Transaction Signing and how it leads to Final Signing and, finally to Deep Archive.

In digital banking, for example, transactions are typically initiated through a digital platform, such as a mobile banking app or a website. When a user initiates a transaction, they are required to provide their account information, the amount they wish to transfer, and any other relevant details.

Before the transaction is processed, users must authenticate themselves through a security mechanism such as a password, fingerprint, or facial recognition. Once the user is authenticated, the transaction request is sent to the bank’s servers for processing.

At this point, the transaction is verified and validated by the bank’s systems to ensure that there are sufficient funds in the user’s account and that the transaction details are correct. If the transaction is approved, the user must then sign the transaction.

For higher-risk transactions, the bank might have multiple levels of approvals before the transaction is successful. During the approval process, the different approving officer can also use their digital signing credentials to approve the transaction. The digital signature serves as mathematical proof that the transaction is approved by the authorized officer and that the information of the transaction is authentic.

As the transaction flows, the next approving officer, the banking system, will verify all digital signature that is applied to the transaction. This ensures that only authentic transactions are being processed. Any transactions that fail verification can be flagged by the banking system for investigation.

Upon completion of the approval processes, the banking system can make its final verification of all digital signatures. Since digital signature also contains the identity of the signers, the banking system can ensure that the transaction has gotten all the required approval. After all verification and validation are completed, the user will be notified that their transaction is approved.

After this transaction is completed, final signing will be applied to the transaction before it is archived. Final signing is the last step in the transaction signing process, where the bank system applies a final digital signature with all required information to ensure that all the transaction information is digitally signed by a bank system signing key.

Hardware Security Modules (HSMs) are specialized devices that are designed to store and manage cryptographic keys and perform cryptographic operations securely. HSMs are used to provide a secure environment for transaction signing, key management, and other security-related functions in digital banking and other industries that require high levels of security.

In digital banking, HSMs are used to store and manage the private keys used for transaction signing. These devices are designed with multiple layers of physical and logical security measures, such as tamper-resistant coatings, secure boot processes, and authentication mechanisms, to ensure the keys’ confidentiality, integrity, and availability.

HSMs provide a secure environment for transaction signing by isolating the private keys from the rest of the system and performing the signing operations in a secure environment. This helps to prevent unauthorized access to the keys and ensures that the signing process is secure and tamper-resistant.

Final signing could also be applied before archiving simple transactions. When a user initiates a transaction in digital banking, the transaction request is sent to the bank’s servers for processing. The bank’s systems then generate a transaction message that includes the transaction details. The message is sent to the HSM for final signing, where the user is required to provide their final authorization before the transaction is completed.

The HSM securely stores the private key used for the transaction signing and performs the final signing operation in a secure environment. The signed transaction message is then sent back to the bank’s servers for processing, and the transaction is completed.

Once the final signed transaction is generated using the HSM, it is often stored in a deep archive as it provides long-term data retention for important records. In a banking context, final signed documents may include financial transactions, loan agreements, account opening documents, and other important records that need to be stored securely for compliance and regulatory purposes.

Other than deep archive for banking, deep archive using solutions like AWS (Amazon Web Services) involves storing data in the cloud on Amazon’s storage service, which is designed to provide highly durable, secure, and cost-effective storage for long-term retention of data.

One of the key advantages of using AWS for deep archive is that it provides a highly scalable and cost-effective solution for storing large amounts of data. This can be particularly beneficial for financial institutions that need to store large volumes of records for compliance and regulatory purposes, as it can help to reduce the cost of storage while ensuring that the records are stored securely and are easily accessible when needed.

Another advantage of using AWS for deep archive is that it provides a high level of flexibility and control over how the data is stored and accessed. For example, data can be stored in multiple regions for redundancy, and data retrieval can be configured based on specific requirements, such as data retrieval time or frequency.

The above demonstrates how deep archive can be applied to a bank, and how digital signatures can be adopted to secure the transactions before deep archive. Deep archive can also be achieved using Cloud technology for cost-effectiveness and scalability.

For more information, contact Netrust Pte Ltd at https://www.netrust.net/contact-us/ or ?sales@netrust.net now.

Follow us on LinkedIn for the latest happenings/updates.